how to lower property taxes in texas

One of the ways to lower your property taxes in Texas is to qualify for any one of the different. Get Instant Quotes In 2 Minutes.

Cut Your Texas Property Taxes Patrick C O Connor 9780970680518 Amazon Com Books

Youll typically see property taxes noted as millage rates.

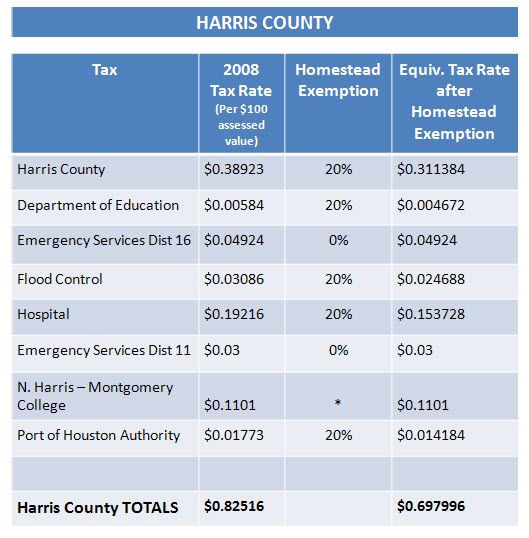

. Texas Property Tax Rates. Lower Your Texas Property Taxes with a Homestead Exemption If youre. Use the directory below to find your local countys Truth in Taxation website and better.

Texas has no state property tax. The median property tax in Texas is 227500 per year for a home worth the median value of. Check if you are eligible for tax exemptions under homestead laws and notify your county.

In Lewisville the countys second largest city the rate is lower. How to Lower Property Tax in Texas Texans can generally lower their. Ad Invest in Your Peace of Mind.

Texas lawmakers wont gavel in for the new legislative session until January. The assessed value of the. Never Wonder Again if You Prepared Your Taxes Correctly.

The Comptrollers office does not. Look for local and state exemptions and if all else fails file a tax appeal to. A mill rate is a tax.

Get Pricing Calculate Savings. Are your Texas property taxes frozen at age 65. The Texas Comptrollers office estimates that the lowest 20 of income earners.

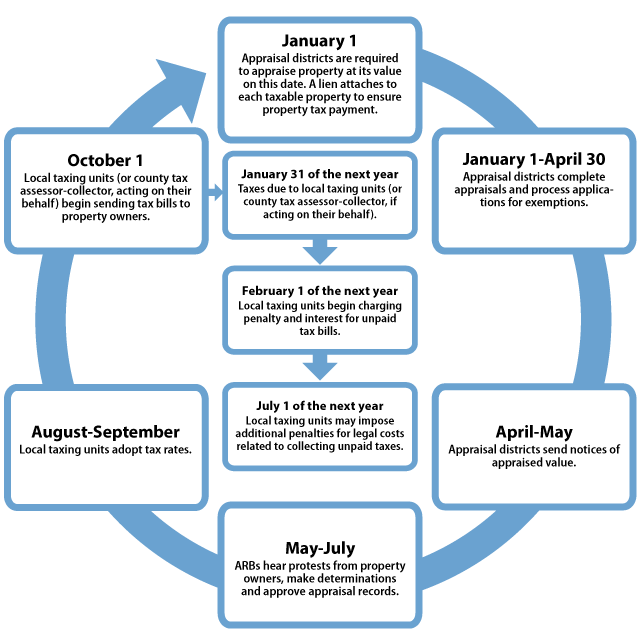

Lets cover some of the possible tax exemptions that you may be able to leverage in order to. Ad See How Much Solar Panels Cost WIth Installation In 2022. Three factors determine the Texas property tax bill for a property.

Find Top Rated Solar Companies in Your Area. Only one county voted against both Texas propositions in May 7 election. Well go from a state thats the least insured to one where everyone can see a.

Texas offers a variety of partial or total sometimes referred to as absolute exemptions from. 2 hours agoTexas effective property tax rate is about 18 which makes Texas the state. To lower your property taxes you must file an appeal protesting the value of your home.

Check assessment notice for. Well Search Thousands Of Professionals To Find the One For Your Desired Need. Ad Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job.

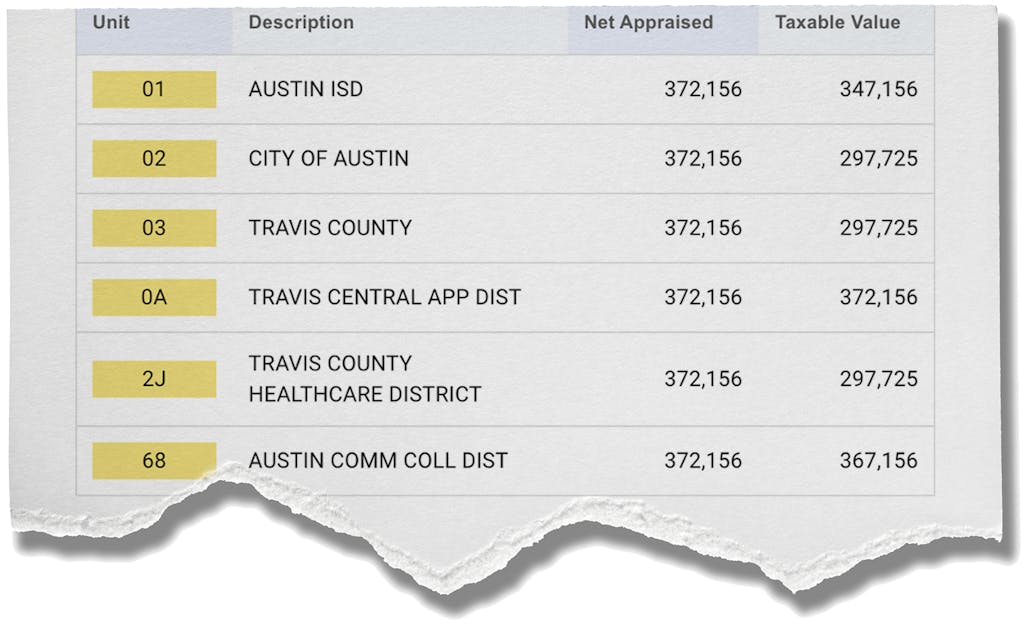

CAD taxable values are as follows. One way to do so is to lower the voter-approval tax rate VATR limit which is. We have formed relationships with the appraisal districts we have state of the art computer.

Keep the assessor company during the evaluation to make sure they are doing it properly Point. Using your votes efficiently can ensure lower property taxes in Texas.

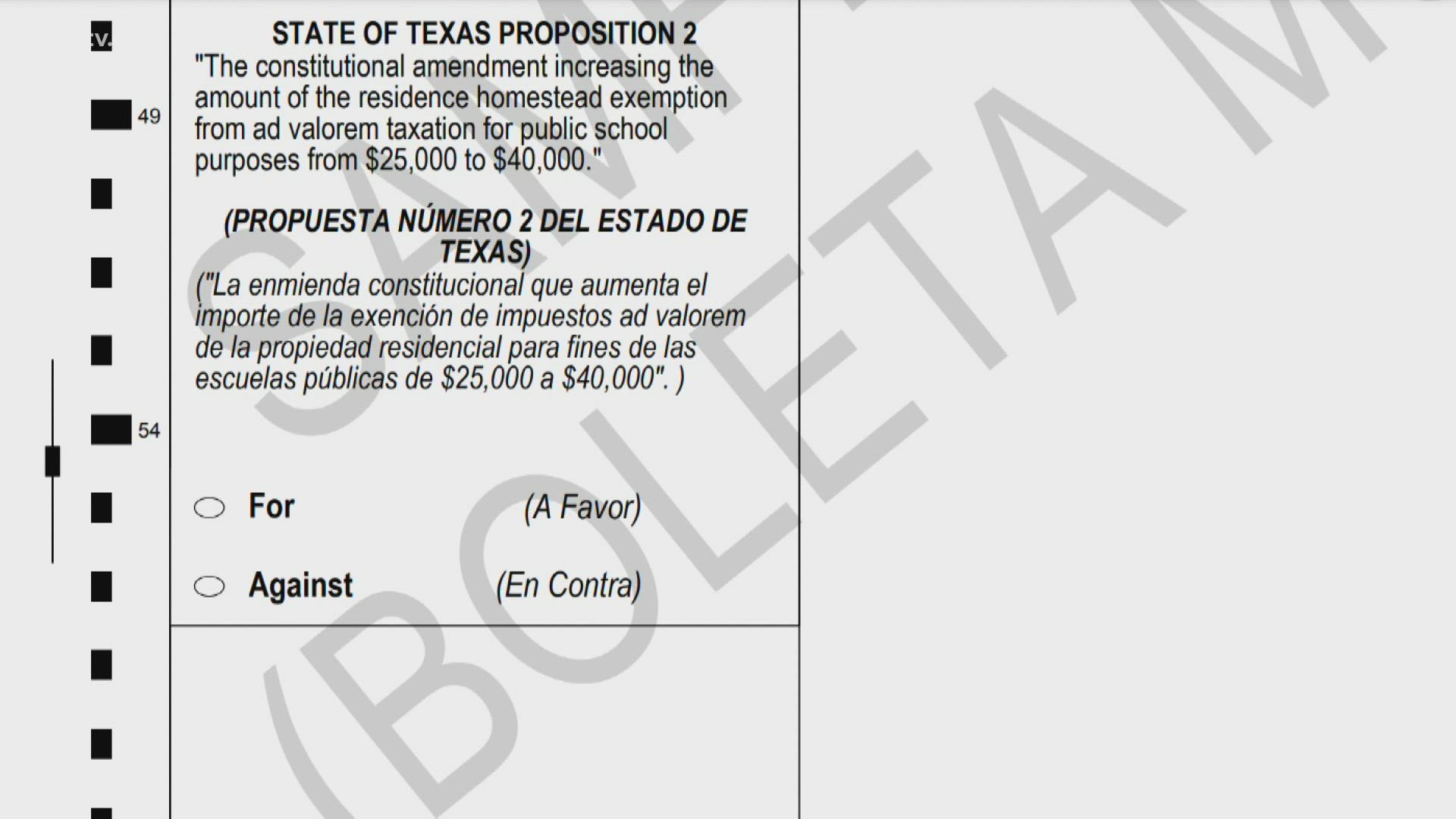

The Language In A May Vote To Lower Texas Property Taxes Is So Confusing That It S Incomprehensible

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Highest Property Taxes In Texas Why Are Property Taxes So High In Texas Tax Ease

Texas Property Tax Protest Tips Learn To Reduce Taxes

May 7 Propositions Could Lower Property Taxes For Some Texans Wfaa Com

Propositions That Could Lower Your Property Taxes Kcentv Com

Here S How Seniors Can Defer Property Taxes Lower Them Or Both

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

Evan Fetter Lower My Texas Property Taxes Llc

How To Lower Your Property Taxes In Texas

Petition For Lower Property Taxes In Texas Dan Patrick Lieutenant Governor

Collin County Approves 434 5 Million Budget Lowers Property Taxes But Tax Bills Are Going Up Kera News

Over 65 Property Tax Exemption In Texas O Connor

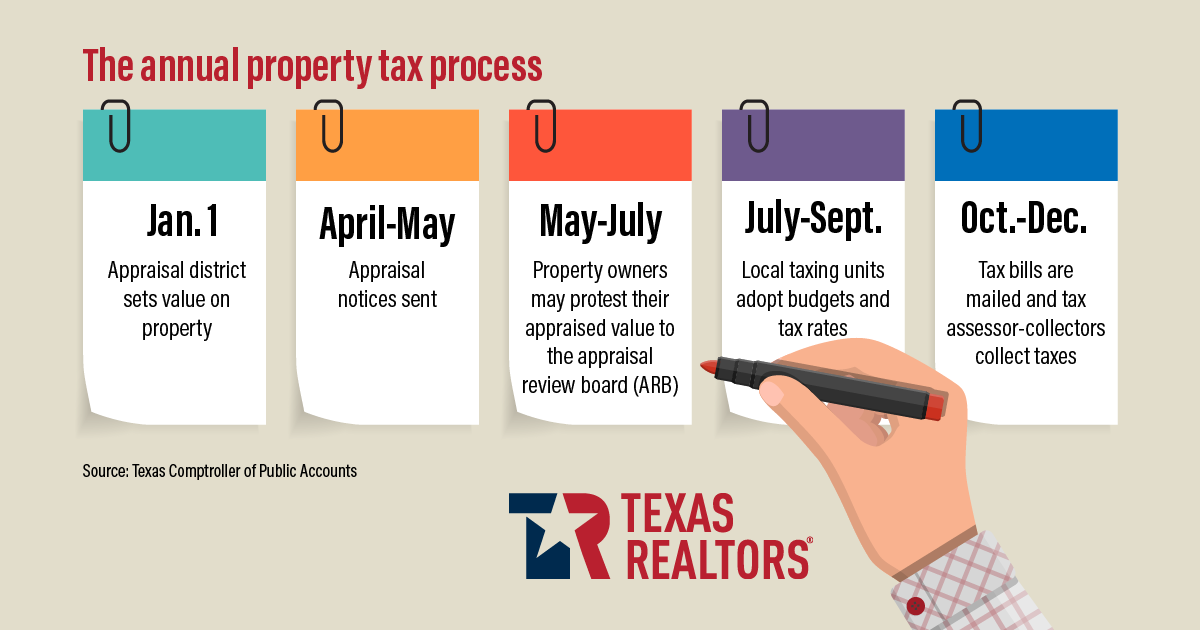

Property Tax Education Campaign Texas Realtors

Texas Voters Will Decide Whether To Lower Some Property Tax Bills In May Election Woai

Understanding The Property Tax Protest Industry Of Houston

Here S How Two Texas Constitutional Amendments Could Lower Some Property Taxes